On Suits, Jeans, and Innovation—An Interview with Roger Park, Lead of Financial Services Innovation & Strategy at EY

On Suits, Jeans, and Innovation—An Interview with Roger Park, Lead of Financial Services Innovation & Strategy at EY

What does innovation mean at EY, and how does it define your efforts within the company?

We define the concept of innovation very broadly. To us, innovation is just about finding new ways to create value. And that can be in the market, in operations, in the middle and back office, in our functions. Being innovative means coming up with new ideas, testing them to make sure they work, packaging them so they can be scaled, and then using those new approaches to transform businesses—both our own businesses and those of our clients.

How do startups and big corporations feed off of each other to make better, more innovative products in the industry? In that setup, who gains the most, innovation-wise?

Well, it depends on how you define startup companies and big corporations—but, I’d say it’s pretty balanced.

Startups usually start out with a few good ideas, are funded by different sources, and are “new” by definition. They tend to be more agile and are more forward-looking in terms of types of technologies they utilize. You’ll typically find them closely tied to emerging spaces, technologies, and business models. So, startups can be a goldmine of new ideas, talent, innovation—and they go a step further by applying those new capabilities and technologies to business problems they believe they can solve.

Big companies come into play by providing infrastructure, scale, distribution networks, and the capability to create the addressable markets for some of those startups to work in. At EY, we actually track quite a few startups—several thousand just in the FinTech community.

So, it’s natural to have collaboration—and even some competition—between startups and large companies. But, we really see more of a collaboration and engagement in what we would call “ecosystems of innovation,” where there are a lot of different ways to come up with new ideas, start a community, and build up into an organization—even an academic community, for example. Then the challenge becomes: how do we apply those ideas to real-world business problems—and then, at the right point, how do we scale those solutions to really transform businesses?

You talk a lot about this concept of ‘suits and jeans’ and the need for them to come together in order to unlock innovation and institution. What do the suits and jeans represent in your analogy?

When we talk about creating real enterprise value—like getting innovation out of the lab, for example, or getting past the proof of concept—I like to frame it as a two-step process. The idea of ‘suits and jeans’ is just shorthand; it’s another way of approaching what we touched on in the earlier question about the relationship between startups and big companies. The way I see it, ‘suits and jeans’ represent two different—yet interchangeable—mindsets.

In the analogy, jeans represent the process or approach to generating new ideas, and new ways of creating value. That means exploring, testing, and learning with new technologies, new business models—really getting “out there.” It’s the first level of experimenting, in the sense that you’re doing lots of different types of experiments. You’re trying to find what works. This is the first step of creating enterprise value—it’s all about generating ideas, coming up with new approaches and new models.

The second step is where the suits come in. In this phase, we scale up all those ideas, approaches, and models—we really put them to use, and we plug them into the functions that drive large-scale complex enterprises. This is where you have to know the risk management, compliance, finance, accounting operations —all the different aspects of a large organization—and make sure that they all get connected so that you can scale the idea to drive real change.

It’s important to note that while we think of suits and jeans as opposite ends of a metaphorical spectrum, in reality, anyone can put on either one at any point in time. The intention isn’t to create an “either/or” dynamic that pits one way of thinking against the other. It’s not about “old school vs. new school” or “young vs. old.” Anyone can wear jeans, just like anyone can put on a suit. We have lots of folks in the office who wear suits, but come weekend, they’re all about the jeans. ‘Suits and jeans’ is an analogy for adopting those particular mindsets, and switching between them.

A lot of folks can switch up; they can be involved in an innovation sprint, a design sprint, or in an innovation lab; and then they can go back and help drive the packaging of those solutions that can then be scaled, safely, across an entire enterprise.

Generally, when we think of accounting and financial services, we don’t immediately think of ‘disruption.’ In fact, many of us want to think of the opposite: stability. How do you orchestrate creativity and disruption with the realities and responsibilities of a traditional, large-scale enterprise?

That’s definitely a good question, and it’s one that comes up quite often with a number of our clients. The first point I’d like to make, though, is that financial services has always been innovative, so the idea of disruption in this sector isn’t entirely new. What’s really changed, however, is the taste of innovation—the taste of change. The accelerating pace of technology, emerging disruptive trends, and the convergence of those trends—everything’s just happening a lot faster than it used to, and it all has to be done at scale.

In large enterprises, there are many obligations and stakeholders to consider, as well as many significant implications for failures or disruption in the marketplace. So, in accounting and financial services—but also more broadly across enterprise—the key is to find a way to innovate at scale efficiently, competitively, but also safely. We call that ‘industrializing innovation.’

So, it’s not a chaotic process necessarily; and we don’t think of it that way. Rather, it’s a very organized, managed process that allows for further creativity—but in a safe environment, and with the type of control and supervision required to do it without slowing anything down.

On many levels—especially when it comes to technology and politics—we’re living in times of rapid change and unpredictability. How can we innovate using today’s standards, knowing that tomorrow is going to bring something totally different?

Nowadays, trying to look ahead even six to 18 months into the future can be difficult, given the emergence and pace of new technology.

I think the rapid rate of change and development that characterize the times in which we live are really the driving force behind what I call today’s ‘explosion of innovation,’ and the interest in driving industrialized innovation across a lot of industries (not just financial services).

The key question we need to ask ourselves at this stage is, how can we rapidly test our ideas and learn from them? And the answer is through gathering feedback from our users. The agile community calls this a minimum viable product. It’s about taking ideas and quickly, efficiently, and safely test them in the real world. Doing this for lots of ideas at the same time creates a wealth of new knowledge and learning. That being said, it’s a considerable challenge to have the right processes and controls and platforms in place to make all that happen, but in reality, that’s something everyone will have to do in order to remain competitive and relevant.

You often talk about the appreciation of willingness to take a risk. How do you know when it’s the right time to take a risk?

I’m not sure there’s a formula for the “right time” to take a risk. The more important issue is around risk management —can an organization handle, manage, and mitigate risk? Organizations that can tackle risk efficiently and effectively are able to take more risks. And in an era where we’re leveraging unpredictability and experimenting with new technologies—in effect, we’re taking risks all the time. Having better risk management is what’s going to give you a competitive advantage going forward. So, it’s not really about which risks to take or when—but rather, how they are dealt with once they have been taken.

So, the process of innovation often comes with a lot of failures along the way. At EY, how do you track and measure the success of your innovation efforts?

Typically, we’re tracking across multiple dimensions. The key is understanding that you are going to fail along the way. Now, that’s not necessarily the goal; obviously, you want to be successful. But, you do need the acknowledgment that in an unpredictable environment, using new technologies and new business models, you’re going to try a lot of different things before you figure out what really works.

When we’re generating new ideas, new approaches, and then testing them very efficiently, we’re tracking that process. We call it the “funnel.” So, it’s about taking 100 ideas, bringing them down to 20, and testing them out very efficiently to find out the 1 or 2 or 5 that will work. Then, we figure out, out of that subset of 5, how do you take these new approaches and connect them with the enterprise functions and other capabilities to really scale them across the enterprise? Scalability of the innovation also turns out to be a key metric.

The EY Financial Services Innovation Center basically helps financial service organizations achieve breakthroughs. What breakthrough technologies on the horizon are particularly exciting for you right now, whether that’s AI, robotics, machine learning—or any other sector?

We’re certainly looking closely at robotics, automation, blockchain, machine learning and advanced analytics.

Blockchain in particular is very interesting from our financial services perspective, both in terms of operations, and from a crypto-assets angle. Of course, there are a number of others that we’re also keeping tabs on, like IoT, drones, quantum computing.

The one technology that I’m personally keeping an eye on is artificial intelligence. I know it’s a broad category, but as hyped as it is, I think it might even be under-hyped—relative to the potential impact it’s going to have. Not just on the financial services industry, but across all industries, in general.

What is it about AI that has you keeping such a close eye on it?

Well, artificial intelligence is a spectrum: there are machines that help you do things faster, machines that help you do things smarter, and then there are the machines that learn. But, what we’re seeing nowadays, is processes, tasks, and activities that can be automated using robotics—and taking it to the next level, where you’re doing adjudication and making decisions based on analytics.

And it’s not just real-time analytics, but in some cases, predictive analytics in models, which is going to drive an acceleration of processes. It’s also going to change the way that we interact with systems and with each other. There’s a concept that AI is the new UI. We’re going to be interacting with AIs, and those AIs will be interacting with each other. Like chat boxes talking to other chat boxes. That’s going to be the new way to interact with and engage with existing systems and available data—and that’s going to be a transformation.

Are there any innovations that you’re skeptical of, or any other issues that innovation cannot fix early on?

I wouldn’t say I’m skeptical of any specific technology, although there are a lot of technologies out there that are still early in the learning cycle. We just don’t know yet how real they are, or how effective they’re going to be, or how they can be applied to real-world business problems.

The one thing I would say about innovation—and maybe emerging technologies in general—is that the technology itself is not the solution. Understanding how that technology can be applied, especially in combination with other technologies, to solve real-world business problems in use-cases—that’s the key to driving real value out of innovation.

You have a career, a family, you run EY’s monthly podcast (Agents of Change), and of course, you have your own other interests—can you give us one work or life hack that you rely on to perform at your best?

Every morning, after getting back from the gym or from a run, I take time to sit down and outline 5 to 10 most important things I want to get done that day.

Lots of things are going to happen throughout the day, but sitting down, planning it out, getting that clarity and focus—and committing to getting a few things done every day is important.

Who throughout history would you say exemplifies a leader in innovation?

There have been a lot of innovative leaders, like Jeff Bezos, Steve Jobs, Bill Gates; Warren Buffet was also an innovator in his field.

But I think a good example would be Benjamin Franklin, as he was someone who was inventive by nature. He crossed so many different domain areas, and contributed in so many different ways; and was constantly experimenting and tinkering. I think that’s really the kind of person I would consider to be the paragon of innovation.

Last question—are you a ‘suits’ or a ‘jeans’ person?

I’m definitely more of a suits person; I do wear suits in the office. But I have jeans in my closet, and I bring them out on the weekend. So, I definitely switch depending on the need. And we’ve got plenty of jeans down in Union Square, so somebody’s gotta wear the suits.

Roger Park is a senior partner/principal in EY’s Financial Services Advisory business with over 20 years of experience in management consulting for the financial services industry. Roger leads the Strategy and Innovation practice in the Americas and is Innovation Leader globally for Financial Services. His primary expertise is in business transformation, business and technology strategy, strategic cost management, digital enterprise transformation, and innovation driven transformation. Roger also leads EYs Innovation Acceleration Network.

Keep up with Roger Park on LinkedIn and Twitter

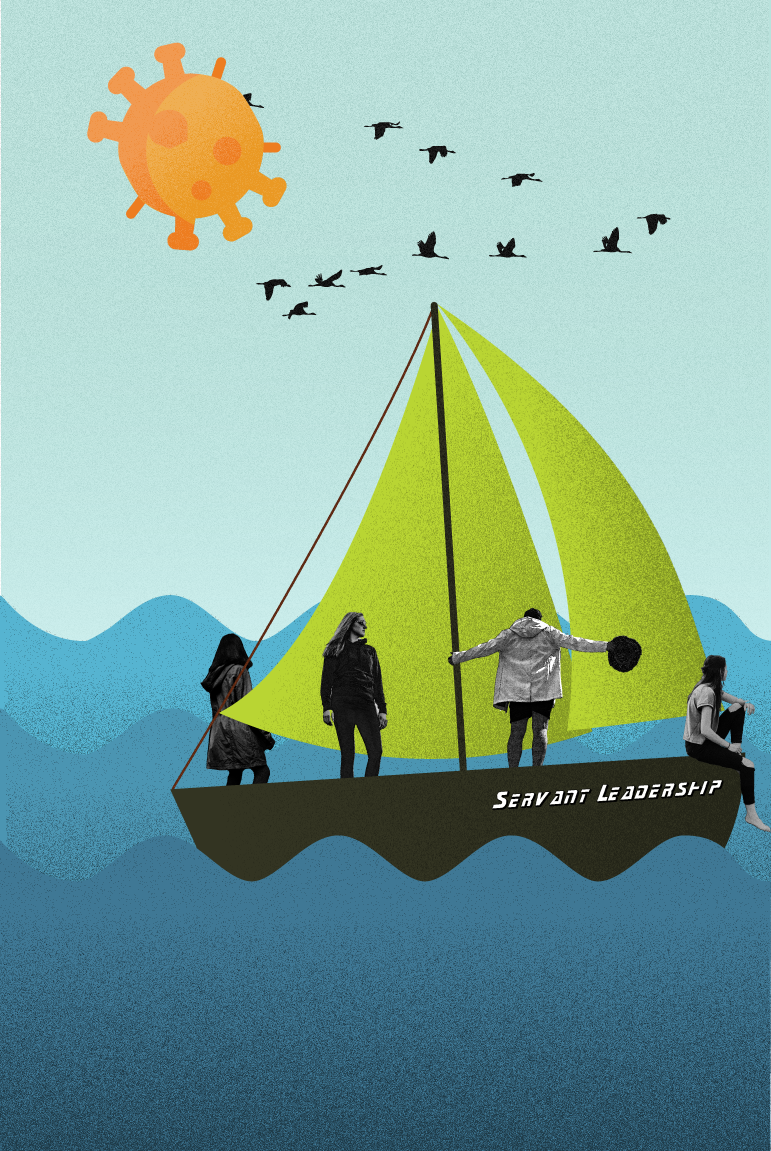

Illustration by Ewelina Karpowiak “Klawe Rzeczy”